Balanced portfolios, which include a mix of stocks and bonds, have had a rough couple of years, while technology stocks have seemed unbeatable.

2022 was one of the worst years for balanced portfolios with stocks in a bear market at the same time bonds suffered historic declines. And in 2023 balanced portfolios didn’t fully participate in the market’s tech-fueled gains.

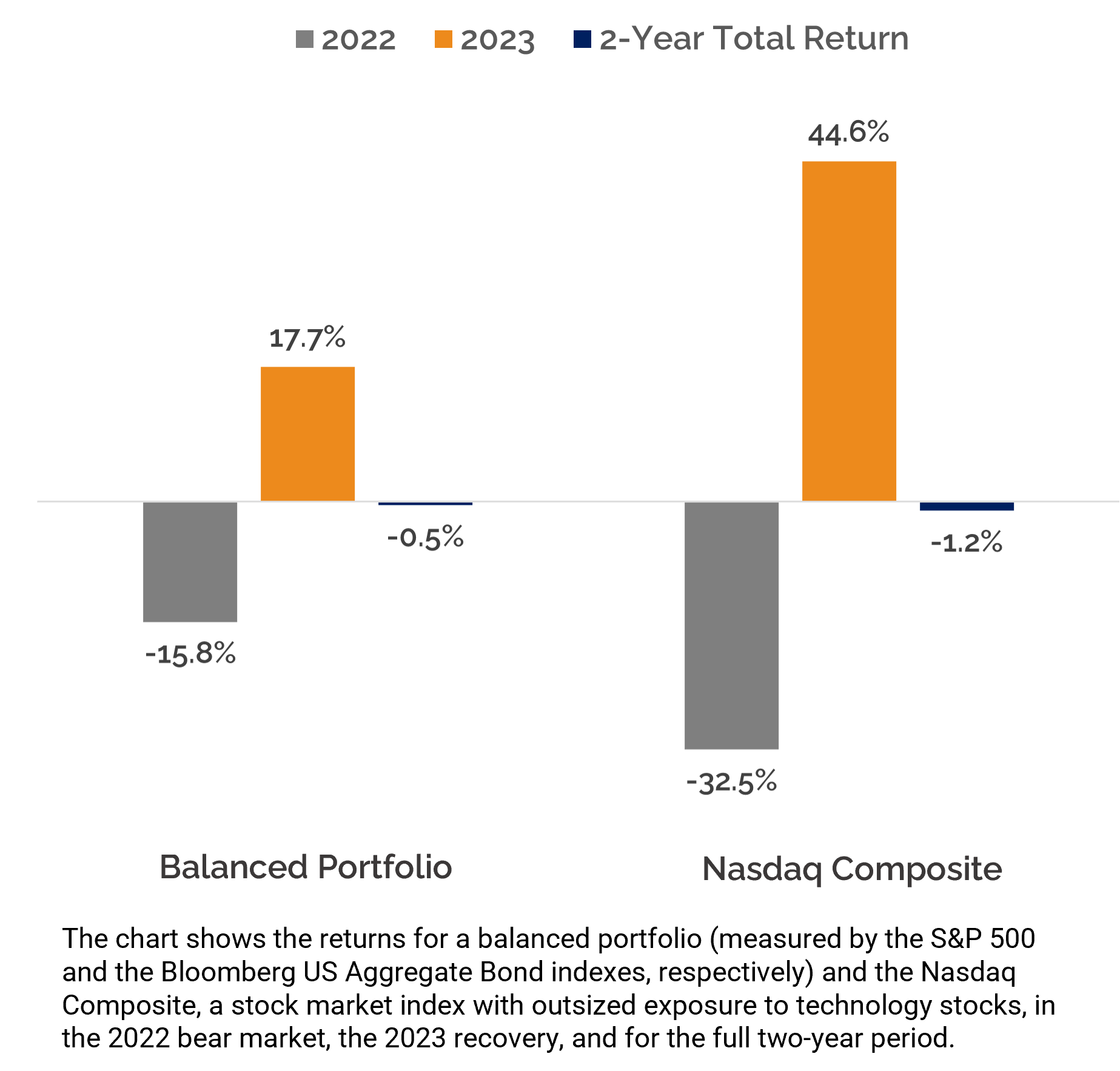

So, it may come as a surprise to learn that a balanced portfolio produced better results than the tech-heavy Nasdaq for the trailing two years ending December 31, 2023.

Balanced 60/40 Portfolio vs Nasdaq Composite

The balanced portfolio held up better in the downturn, so it had an easier time recovering its losses when markets turned around. It had almost fully recouped its losses by the end of 2023, while the Nasdaq was still down slightly, despite massively outperforming the balanced portfolio over the trailing year.

While two years is a short window of time for investing, this a recent example of how taking too much risk can be detrimental to your wealth.

Investors who take more risk hope to increase their chances of earning outsized returns, but they also increase their chances of experiencing substantial losses. Major losses are harder to recover; as the Nasdaq shows, you need to gain more than you’ve lost just to break even and that can take years.

Steep losses also take an emotional toll, increasing your anxiety, adding stress, and making it more difficult to stay on track.

Could balanced funds and ETFs improve your results?

A balanced portfolio is designed to participate in the stock market gains with fewer major losses and less stress along the way. And, as the last two years show, balanced portfolios can generate competitive results even in difficult conditions and the lower volatility is easier to live with.

Balanced funds and ETFs (also known as allocation funds), which combine stocks and bonds into one investment, have been shown to help investors improve their results.

Investors often underperform because they tend to trade funds at inopportune times, selling during a market downturn and buying back in after a sustained market rally. Morningstar examined the gap between investor returns and fund returns over the 10 years ending December 31, 2022 and found investors who owned balanced or allocation funds captured more of their funds’ returns than investors in riskier funds.

During this 10-year time frame, investors in allocation funds had the smallest gap of any Morningstar category, while investors in sector equity funds had one of the largest gaps.

Combining different asset classes, such as stocks and bonds, Morningstar noted, “mitigates the risk that an investor will respond impulsively to the performance of any one component.”

Simple approach to a balanced portfolio

Investing in a balanced portfolio can also simplify your investing by eliminating the need to spend your time managing both a stock allocation and a bond allocation or hunting for an optimal mix of stocks and bonds.

FundX Conservative ETF (XRLX), formerly FundX Conservative Upgrader Fund (RELAX), is designed to help simplify your balanced portfolio in five key ways:

-

1. Simplify your allocation decisions. XRLX targets a 60/40 mix of core stock and bond ETFs. The portfolio is balanced and rebalanced for you.

-

2. Simplify your investment decisions. XRLX is actively managed to capitalize on opportunities as markets change, seeking both growth and stability in stocks and bonds.

-

3. Simplify your taxes. ETFs like XRLX rarely distribute capital gains that can drive up your taxes.

-

4. Mitigate market volatility. A balanced portfolio like XRLX is designed to smooth out the ups and downs of the market and provide more consistent returns over time than an all-stock portfolio.

-

5. Diversify your smaller accounts. XRLX is an easy way for investors who are managing smaller accounts to own a full stock and bond portfolio in one ETF.

Invest in FundX Conservative ETF today. XRLX is available at all major brokers.

Questions about managing risk or allocating your portfolio?

Let’s talk.

If you’re frustrated trying to find an appropriate balance of risk and return or you feel uncertain about your allocation, please give us a call at 800-323-1510 and ask to speak with an advisor. We’ve been helping investors mitigate risk and align their investments with their goals for more than 50 years.