Most investors aim to make tax-smart investment decisions, so they can reduce their tax costs and keep more of their gains. But this has been difficult for mutual fund investors to do in recent years as funds have made some surprisingly large capital gain distributions–even in down markets.

In 2022, the average US equity fund distributed 7% in capital gains to shareholders, according to Russell Investments, while the S&P 500 was down almost -20%. Many funds made even larger distributions: Nearly 300 funds distributed more than 10%, and more than 50 funds paid out 20% or more in capital gains in 2022, according to CapGainsValet.

The tax burden of capital gains distributions

Investors who own funds in taxable accounts are taxed on any distributions of capital gains or income they receive from their funds, so large distributions can lead to a large tax bill.

If you had a $500,000 investment in an equity fund that made a 7% long-term capital gain distribution in 2022, and you are taxed at the top long-term capital gains tax rate (20%), you’d owe roughly $7,000 in taxes. If the fund distributed the same amount as a short-term capital gain, it would be taxed at your income tax rate, and if you’re in the top income tax bracket (37%), your tax bill would be nearly $13,000 on this one position. Since investors often own more than one fund, the taxes can really add up

Most investors accept that they’ll owe some taxes on their investments, and if they know that their taxes will be higher, they can plan and budget for it. But mutual fund distributions can be unpredictable and typically change from year to year. A fund may not distribute capital gains for years, and then it may unexpectedly make a sizable payout that catches investors off guard.

And since funds usually distribute capital gains at the end of the tax year, investors don’t have much time to figure out how to best mitigate the tax impact.

How can investors avoid mutual fund distributions?

Investors can usually avoid receiving a fund’s distribution by selling the fund before the record date (typically the day before distributions are paid), but since investors will still be taxed on any gains they realize from the sale, this may not lower their tax bill.

Many investors have found that a simpler way to mitigate their investment taxes is to invest in exchange-traded funds (ETFs), which rarely make capital gains distributions (though they may distribute income quarterly).

The tax-efficiency of ETFs was one of the reasons why we converted two of the FundX Funds into ETFs in 2022.

ETFs typically don’t make capital gains distributions

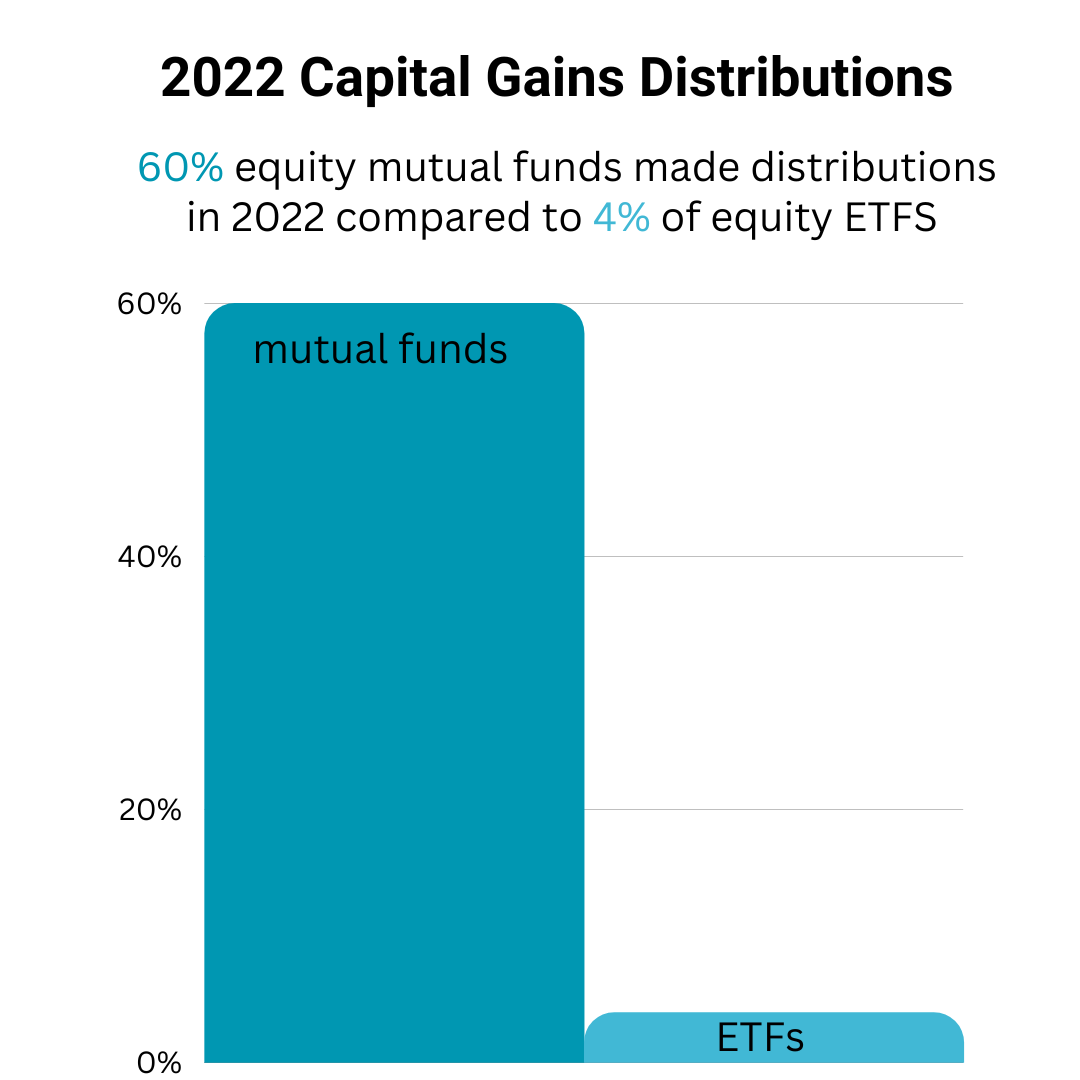

ETFs make far fewer capital gains distributions than mutual funds. In 2022, for example, 60% of equity mutual funds made distributions, according to Capital Group, compared to 4% of equity ETFs. That’s consistent with a 2022 Morningstar study that looked at the 10 years through 2020 and found that ETFs made capital gains distributions “far less frequently” than mutual funds, and that ETFs that paid distributions to shareholders “tended to make much smaller payouts than their mutual fund counterparts.”

The tax-efficient structure of ETFs

Why are ETFs able to make fewer capital gains distributions? ETFs are structured differently than mutual funds, and the ETF structure is designed to minimize taxes. For example, ETF shares are traded between investors on an exchange, which means that an ETF doesn’t have to realize any capital gains in order to meet shareholder redemptions like mutual funds do.

ETFs also have a unique and tax-efficient process for creating and redeeming shares. ETFs have a third party (called an authorized participant or AP) that manages the supply of ETF shares on the market by exchanging “creation units”—baskets of securities that approximate the ETF portfolio—with the ETF for shares. This exchange is considered an in-kind transfer, which doesn’t realize capital gains.

ETF.com explained that “the ETF issuer can even pick and choose which shares to give to the AP—meaning the issuer can hand off the shares with the lowest possible tax basis. This leaves the ETF issuer with only shares purchased at or even above the current market price, thus reducing the fund’s tax burden.”

When ETF investors are taxed

Investors who own ETFs in a taxable account will still owe taxes on any gains they realize when they sell their shares. However, investors usually have more control over when they make trades in their accounts. They can choose to realize fewer gains in a year when they anticipate higher taxes and more investment gains in a lower-tax year (or in a year when they have realized losses that they can use to offset their gains). With careful planning, ETF investors may find that their investment taxes are more predictable and that they have fewer surprises at tax time.

FundX ETFs: Active management in a tax-efficient ETF

FundX ETFs may be a good fit for investors who are managing taxable accounts and looking to minimize their investment taxes. You can invest in the FundX ETFs at all major brokers, including Charles Schwab and Fidelity.

The S&P 500 Index is a broad-based unmanaged index of 500 U.S. stocks, which is widely recognized as representative of the U.S. equity market.